Talk about a tempestuous relationship! In the past month I’ve gotten a demand, a threat, a thank-you note and an apology.

My torrid affair, you may as well know, is with the Internal Revenue Service.

Our correspondence began with a CP11 notice informing me that there had been a “miscalculation” on my tax form.

“As a result,” the feds told me, “you owe $402.45.”

I wasn’t happy about this, needless to say. When I paid my 2020 taxes, I felt that I had done my miniscule bit to chip away at the revenue shortfall resulting from Donald Trump’s years of tax dodging.

But I was also impressed that somebody even noticed that I had underpaid. Good work, Team IRS!

Virtuous citizen that I am, I quickly made electronic arrangements to make Uncle Sam whole. That, I thought, was the end of that.

Except it wasn’t.

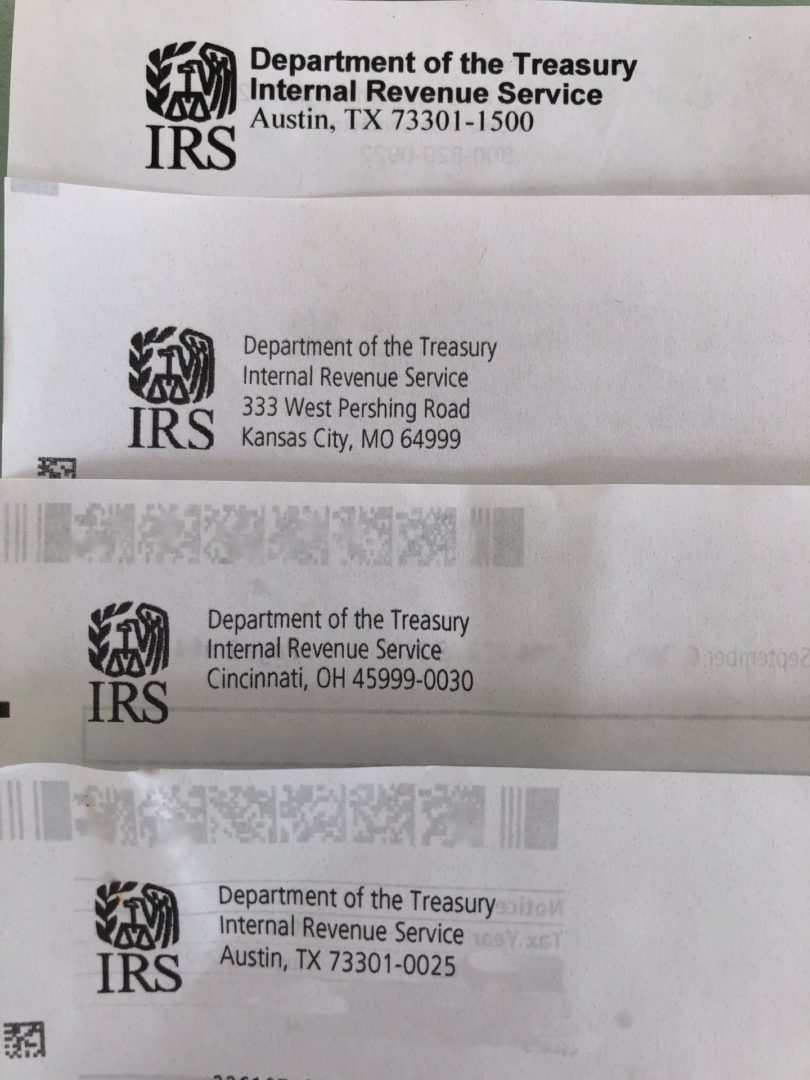

A couple of weeks later, a CP501 notice landed in my mailbox. The return address on CP11 had been Austin, Texas. CP501 came from Cincinnati.

“We recently contacted you about your past due 2020 taxes,” said CP501. “You must pay your balance immediately.”

The amount was now $403.61. An additional $1.16 in interest had been tacked on. Along with a threat:

“If you have not paid the debt already, a federal tax lien has arisen as a claim against all your property.” The threat continued for another 60 words, the upshot of which was that I might be left naked on a sun-scorched, wind-swept plain.

Oh yeah? thought I. Well for your information, Sammy boy, I have proof that I paid my debt: I had cleverly printed confirmation that my payment had been submitted. But I dreaded having to call them and go through the whole “if you’re madder than a wet hen, press 1” routine, with staticky musical interludes in between and minutes of my one wild and precious life draining away.

So I decided to wait. Maybe Austin hadn’t gotten around to telling Cincinnati that I’d come across with the dough.

Sure enough, a week later, I received a CP301 notice, better known to us laypersons as a thank-you note. There weren’t any hearts or flowers or kitties on it, but in large letters it said, “Thank you for using the IRS online services.”

CP301 was from Kansas City. Note that KC didn’t specifically thank me for forking over the 400 smackers, which planted a seed of doubt in my mind. Were they thanking me for setting up an account, but somehow unaware that I had set up the account for the purpose of paying what I owed? Or was this their coy way of thanking me for paying? There was no way to know for sure.

And as for spending taxpayer money on a thank-you note: Really, they needn’t have. I began to think maybe they don’t have enough to do at those IRS outposts in Austin, Cincinnati and Kansas City.

But I wouldn’t have written this column if I did not receive yet another missive last week. Austin again. No notice number this time, just a reminder about the original notice re the error on my return – as if I could have forgotten about the hole in my checking account where $402.45 had been.

Then the letter got interesting.

“This letter provides more information about your right to appeal and we apologize for not providing it in the previous notice.”

Instructions for contesting the charge followed. If the IRS had erred in not telling me how to appeal, might it have erred in recalculating my tax in the first place?

I read on.

“If you don’t contact us within 60 calendar days from the date of this letter, the change will not be reversed and, if tax is due, we will begin the collection process.”

Whaddaya mean, begin the collection process? On the one hand, they’re allowing for the possibility that I might not have owed any additional tax after all. On the other hand, they’re still not acknowledging that they received the additional tax.

The federal budget for the year 2020 was $4.79 trillion. The $400 I owed – assuming I really owed it – was less than .00000001 percent of that sum. And yet, federal workers in Austin, Cincinnati and Kansas City have sent me notice CP11, notice CP501, notice CP301 and a letter without a notice number, and it still is not entirely clear to me whether they charged me in error, whether they have received the money I sent them, or whether they’re going to send a bunch of gorillas and a big truck to State College, jack up my house and haul it away because .00000001 percent of the federal budget is missing.

I don’t know whether to be impressed by my government’s attention to detail or appalled at the number of person-hours, postage and printing costs they devote to going after small fry like me while Citizen Trump and the other sharks swim blithely away.