Centre County Commissioners on Tuesday unanimously adopted a tentative 2024 budget that includes no real estate tax increase for the 14th consecutive year.

The $141.7 million total budget will be open for a 20-day public review period online and at the Willowbank Building (420 Holmes Street, Bellefonte) before a final vote is expected at the board’s Dec. 5 meeting.

With no tax increase, the county millage rate would remain at 7.84 mills.

“This represents really a lot of work over the last few months to ensure that our budget is lining up with our priorities, our mandates in terms of what we’re required to do and what the community’s expectations are for us as a county in terms of the level of service we provide,” board Vice Chair Amber Concepcion said.

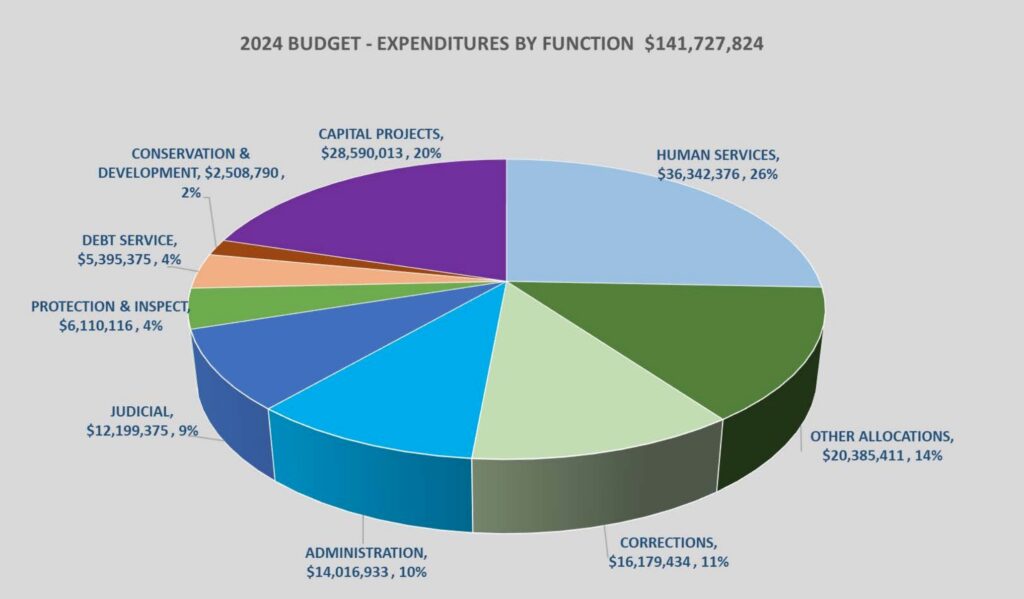

The overall fiscal plan includes a $28,590,014 capital budget, “much larger than you’ve seen in quite some time,” Richard Killian, budget and finance director, said. The capital budget includes work on the courthouse, namely the replacement of retaining walls, as well as the major renovation of the former Centre Crest building in Bellefonte to bring multiple county offices under the same roof and maintenance and updates to the county’s Willowbank Building.

In 2022, the county issued $40 million in general obligation bonds to fund capital projects. The funds remaining from the issuance will be used for the 2024 capital budget and any deficit would be filled with American Rescue Plan Act funds, board Chair Mark Higgins said.

Operating budget expenditures of $113,137,810 mark a 6% increase over 2023. Increases in employee insurance coverage and liability insurance are among the main factors.

The cost of employee benefits will increase by nearly $1 million to $13.17 million. Salaries will decrease by $430,644 to $29.72 million, bringing the total for salaries and benefits to about $42.9 million, or a $568,336 increase.

Contracted services are $29.5 million, a $2.47 million increase over 2023.

“That’s a lot of the funding for the roughly 100 nonprofits that the county works with to provide human services and a broad variety of other benefits to local residents,” Higgins said. Killian added that the vast majority are reimbursed through grants.

Human services are the largest budget category at $36.3 million, about 26% of the total budget and 36% of the operating budget.

“I think it’s a very sound budget considering the aggressiveness of the investments that we’re putting into county infrastructure to continue the services to the residents,” County Administrator John Franek said.

Revenues in the proposed budget total $112,198,712, a 5.1% increase over 2023. Those include a projected growth in assessed property values of 1.66%, bettering the 1.28% 10-year average and an increase in state and federal grants. Higgins also noted that year-to-date the county has seen a 200% increase in interest earnings over what was budgeted.

Grants and payments in lieu of taxes make up 51% of the total budget at about $57 million, while real estate taxes constitute 27% at about $29.7 million. Departmental earnings are 17% ($19.5 million) and internal charges are 5% ($6 million).

The proposed budget uses general fund reserves and American Rescue Plan Act funds “to maintain current funding levels for the provision of county services,” Killian said. It will maintain 11.1% of expenditures in reserves, which Killian said falls within the best practices range.

“I’m going to remind the board that this ARPA money doesn’t last forever and at some point we’re going to have to tighten up our belt and make sure that we can function moving forward without those subsidies,” Commissioner Steve Dershem said. “I hope that the Centre Crest project goes without a hitch and we have no unexpected issues there. It will be interesting to see how 2024 treats us in the end and hopefully we don’t see any nationwide economic declines or anything that challenges us.”