Unlike federal and state income tax returns, the deadline to file 2020 local tax returns in Pennsylvania is still scheduled for Thursday. But Centre County residents who need more time won’t need to worry about penalties for being a little late.

The Centre County Tax Collection Committee on Monday adopted a resolution to waive all penalties and interest on late income tax filings and payments through May 17, aligning with the state and federal deadlines for 2020 returns.

On March 17, the Internal Revenue Service announced that the due date for filing and payment of 2020 taxes would be extended another month “to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities.”

Pennsylvania’s deadline for filing state income tax returns is tied to the federal deadline and on March 18 the Department of Revenue announced the state deadline would also be May 17. The changes do not apply to estimated tax payments.

Under the Local Tax Enabling Act, however, local agencies are not authorized to change their due dates. Last year, legislation approved by the General Assembly and signed by Gov. Tom Wolf extended the deadline for local taxes to match the state and federal extension, but no such action has been taken this year.

So while the local deadline remains, the resolution means Centre County residents won’t face penalties as long as they file and make payments by May 17.

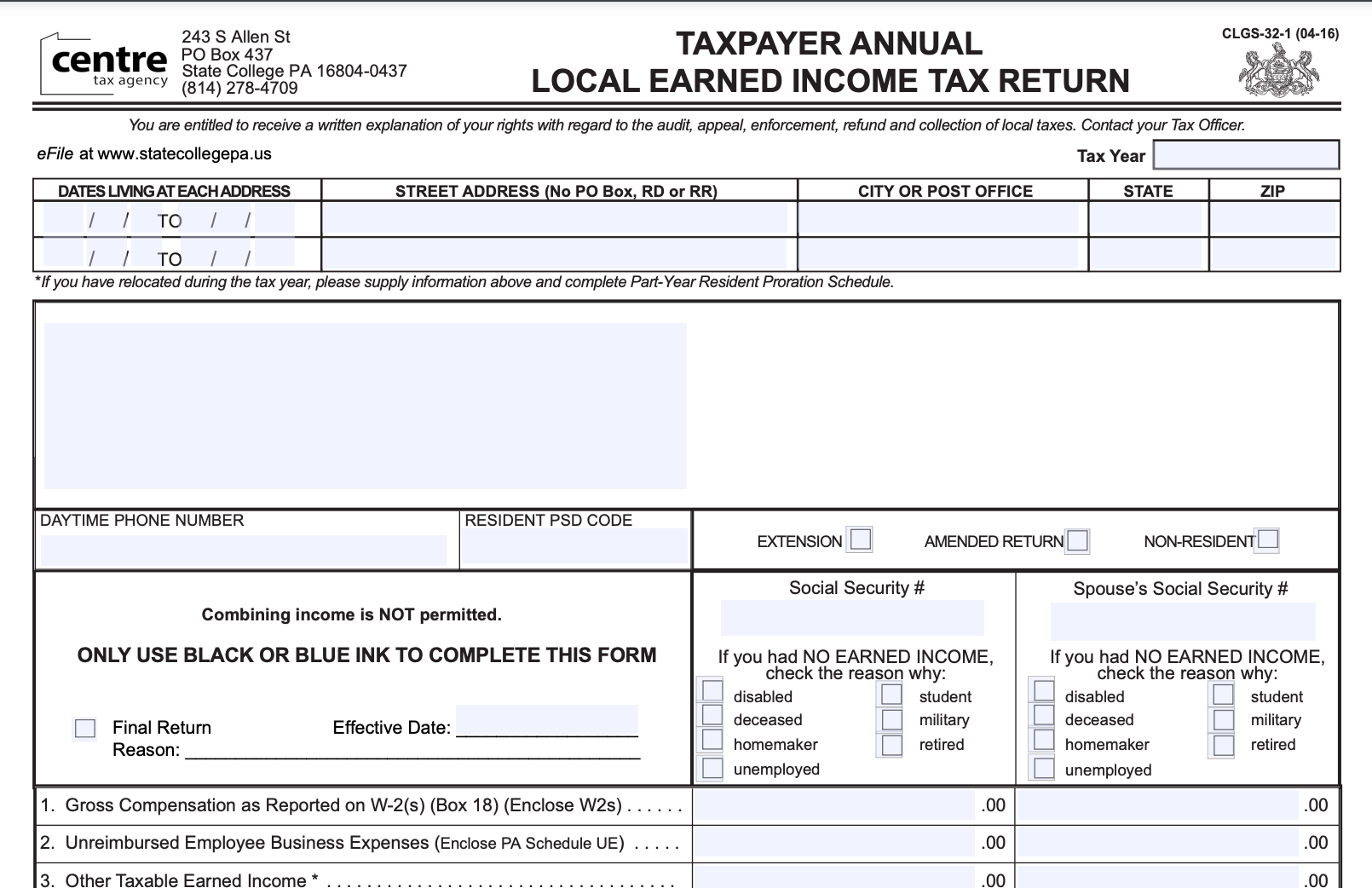

Randy Brown, the State College Area School District finance and operations officer and chairman of the Centre County Tax Collection Committee, said during the April 5 State College School Board meeting that the school district and local tax collector Centre Tax Agency have been contacted by multiple employers, tax preparers and residents asking why local earned income tax had not been delayed to match state and federal deadlines.

Brown said he was “very disappointed” that the state had not made a change for local taxes.

“I have been and will continue to work with the legislators and also the Department of Community and Economic Development to attempt to get this legislation enacted. Unfortunately the situation is beyond my control,” Brown said at the time. “I’m doing what I can to make sure that the powers that be in Harrisburg can make this change… I have attempted my due diligence but I will continue to make daily calls until something happens.”

Brown added that the tax collection committee is empowered to waive penalties and late fees, even if it cannot change the filing deadline.